Treffer: 619

Die Finanzen des Rasselstein in den Jahren 1823-24Autor/Hrsg.: Spoo, Hans HermannJahr: 1989

Rasselstein of Neuwied, West Germany, was the most important industrial enterprise on the Rhine between Mayence and Bonn well before the take-off of the industrial revolution in Germany (and remains such today). In the 1820s the steel mill was the fi...

Untertitel: Ein Beitrag zur Frühgeschichte der rheinischen Industrie (Teil I und Teil II)Rasselstein of Neuwied, West Germany, was the most important industrial enterprise on the Rhine between Mayence and Bonn well before the take-off of the industrial revolution in Germany (and remains such today). In the 1820s the steel mill was the first in Germany to introduce puddling. The brief yet determinating period in the company\'s history is well documented. From a technological point of view it has been treated in detail by Ludwig Beck (see note 0). The present study: «The Finance of Rasselstein in 1823 and 1824. A Contribution to the History of Early Industrialization in the Rhineland» deals with the company\'s money affairs. Whereas bookkeeping seems to have been behind the times, methods of payment were complicated, capital was still a matter of family connexions and slow to turn over, modern ideas and practice already prevailed in active business: e.g. reasonable terms of payment, preference for cashless payment, superior handling of the bill of exchange, extensive use of banking facilities, systematic and unresting effort to raise outside money particularly for congruent financing of investment. There is evidence enough of a management well ahead of their time as to salesmanship, initiative, method, vision, skill in pooling resources. The early appearance of entrepreneurial spirit in the Rhineland - early by German standards - is a well known fact, evidence of financial practice, in contrast to technology, is rather rare and may therefore be all the more interesting.

Rasselstein of Neuwied, West Germany, was the most important industrial enterprise on the Rhine between Mayence and Bonn well before the Take-Off of the industrial revolution in Germany (and remains such today). In the 1820's the steel mill was the f...

Untertitel: The Finance of rasselstein in 1823-24. A Contribution to the History of Early Industrialization in the Rhineland (Part II)Rasselstein of Neuwied, West Germany, was the most important industrial enterprise on the Rhine between Mayence and Bonn well before the Take-Off of the industrial revolution in Germany (and remains such today). In the 1820's the steel mill was the first in Germany to introduce puddling. The brief yet determinating period in the company's history is well documented. From a technological point of view it has been treated in detail by Ludwig Beck (see note 0). The present study: "The finance of Rasselstein in 1823 and 1824. A Contribution to the History of Early Industrialization in the Rhineland" deals with the company's money affairs. Whereas bookkeeping seems to have been behind the times, methods of payment were complicated, capital was still a matter of family connexions and slow to turn over, modern ideas and practice already prevailed in active business: e.g. reasonable terms of payment, preference for cashless payment, superior handling of the bill of exchange, extensive use of banking facilities, systematic and unresting effort to raise outside money particularly for congruent financing of investment. There is evidence enough of a management well ahead of their time as to salesmanship, initiative, method, vision, skill in pooling resources. The early appearance of entrepreneurial spirit in the Rhineland - early by German standards - is a well known fact, evidence of financial practice, in contrast to technology, is rather rare and may therefore be all the more interesting.

Die Freiheit der UnternehmerAutor/Hrsg.: Röseler, KlausJahr: 1969

Die Frühgeschichte der LufthansaAutor/Hrsg.: James, HaroldJahr: 1997The article examines the role of Deutsche Bank in promoting the formation of Deutsche Lufthansa in 1920, as a result of a merger of two firms with completely different commercial and political traditions: the internationalist Deutsche Aerolloyd AG an...

Untertitel: Ein Unternehmen zwischen Banken und StaatThe article examines the role of Deutsche Bank in promoting the formation of Deutsche Lufthansa in 1920, as a result of a merger of two firms with completely different commercial and political traditions: the internationalist Deutsche Aerolloyd AG and the intensely nationalistic Junkers transportation company. Von Stauss of Deutsche Bank, as Chairman of the Supervisory Board, continued to play a critical role, after 1926 in dealing with disputes about routing, about procurement, and about relations with the state. The major problem of the new firm lay in its dependence on state subsidies, which soon, created major difficulties during the fiscal stringency of the Great Depression. After 1933, the fortunes of Lufthansa were linked with the new Luftwaffe; both were now directly controlled by the state, rather than by bank influence.

Between 1875 and 1890 the small optical workshop of Carl Zeiß in Jena developed into a modern factory for mechanical/optical precision instruments. This change was the result of Ernst Abbe's theoretical work in the field of microscopic image formati...

Between 1875 and 1890 the small optical workshop of Carl Zeiß in Jena developed into a modern factory for mechanical/optical precision instruments. This change was the result of Ernst Abbe's theoretical work in the field of microscopic image formation which he had started in the second half of the 1860s and brought to a certain conclusion in the middle of the 1880s. Ernst Abbe's findings now allowed microscopes to be manufactured according to scientific principles. This new approach came, however, only fully to fruition with the development of special optical glasses by Otto Schott molten in the Jena glass factory since 1884.

Carl Zeiß and Ernst Abbe used these innovations in the manufacture of scientific instruments with great prudence and in the interest of the commercial development of the company.

Die gewerbliche Wirtschaft Salzburgs von 1816 bis 1860Autor/Hrsg.: Wysocki, JosefJahr: 1979

Die Grafen von FriesAutor/Hrsg.: Matis, HerbertJahr: 1967Untertitel: Aufstieg und Untergang einer Unternehmerfamilie

Untertitel: 140 Jahre Erste Donau-Dampschiffahrts-Gesellschaft - Größe und Bedeutung der österreichischen Donauschiffahrt

Die Gründung der Darmstädter BankAutor/Hrsg.: , Rondo E. CameronJahr: 1957

Die Gründung der offiziellen Deutsch-Französischen Industrie- und HandelskammerAutor/Hrsg.: Riedberg, GerdJahr: 1982The foreign chambers may be looked upon as successors of the association of merchants engaged in export in the Middle Ages. Yet, in the way we understand foreign chambers of industry and commerce today, their history has only begun in the second half...

The foreign chambers may be looked upon as successors of the association of merchants engaged in export in the Middle Ages. Yet, in the way we understand foreign chambers of industry and commerce today, their history has only begun in the second half of the 19th century, starting in England and in the USA. The first German foundation of that kind was in Brussels in 1894, which was followed by one in Bucharest in 1902. Both chambers existed just a short time. The German Chamber of Commerce in Paris was founded as an initiative of representatives of German companies. The Chamber was to promote German-French commercial relations. The new Chamber soon became important for the commercial relations and was in high repute when the outbreak of World War 11 stopped the development.

The end of World War 11 demanded a fresh start. After some trouble at first, the official German-French Chamber of Industry and Commerce was founded in 1955. It soon became an important and appreciated connecting link of the two economies. It helped German and French merchants and firms in many ways and brought about numerous cooperations between firms.

Die Gründung der Preußischen Central-Boden-Credit AGAutor/Hrsg.: Seidenzahl, FritzJahr: 1964

Die Hamburger Seeversicherung vom 17. bis zur Mitte des 19. JahrhundertsAutor/Hrsg.: Denzel, Prof. Dr. Markus A.Jahr: 2020Hamburg’s marine insurance from the 17th to the middle of the 19th century

In the eighteenth century, Hamburg emerged as the third-most important marine insurance market in North-West Europe, after Amsterdam and London, with an impact in the entire...

Hamburg’s marine insurance from the 17th to the middle of the 19th century

In the eighteenth century, Hamburg emerged as the third-most important marine insurance market in North-West Europe, after Amsterdam and London, with an impact in the entire Baltic Sea area, but partially in ports along the Atlantic coast and in the Mediterranean as well. On the basis of selected examples this contribution outlines the long-term development of marine insurance rates and explains how and why it gradually became less and less expensive to insure ships and goods in maritime transport. At the same time, the paper examines the factors of pricing of the marine insurance rates, i. e. analyses the significance of different various risk factors. Finally, the importance of (marine) insurance as a central transaction cost of trade and (maritime) transport in pre-industrial times is made clear. It is explained, that the long-term minimalisation of the risks involved in the maritime traffic did start only after the Napoleonic Wars and the subjugation of the last pirates in the Atlantic and the Mediterranean, which, however, occurred long before the introduction of steam shipping and other innovations in maritime transport and international communication.

Die Hansa und die GermaniaAutor/Hrsg.: , Friedrich PüserJahr: 1957

Die Industrialisierung der Hausbaues: Christoph und UnmackAutor/Hrsg.: Wurm, HeinrichJahr: 1969

Die Institutionalisierung der Unternehmensgeschichte im deutschen SprachraumAutor/Hrsg.: Schröter, Harm G.Jahr: 2000After the Second World War different organisations for Business History emerged in Austria, the FRG, GDR, and in Switzerland. The Author connects these foundations and their development to the ongoing discourses in society and the academic world whil...

After the Second World War different organisations for Business History emerged in Austria, the FRG, GDR, and in Switzerland. The Author connects these foundations and their development to the ongoing discourses in society and the academic world while simultaneously pointing out to the involvement of certain decisive persons. Thus he tries to apply Douglas North' theory of institutional change to the subject of Business History

Die Jaluit-GesellschaftAutor/Hrsg.: Treue, WilhelmJahr: 1962

Die Kalker Trieurfabrik und Fabrik gelochter Bleche Mayer & CieAutor/Hrsg.: Huck, JürgenJahr: 1970

Die Klosterkammer und der Hannoversche Klosterfonds unter der Herrschaft der NSDAP. Autor/Hrsg.: Stalmann, AlbrechtJahr: 1962Untertitel: Der zwölfjährige Kampf um das Bestehen der Klosterkammer

When Richard Ehrenberg in 1896 published his two-volume work on «Das Zeitalter der Fugger» his intention was to characterize the extraodinary importance of the Augsburg banking house. Research done since Ehrenberg has proved that the label «Zeital...

When Richard Ehrenberg in 1896 published his two-volume work on «Das Zeitalter der Fugger» his intention was to characterize the extraodinary importance of the Augsburg banking house. Research done since Ehrenberg has proved that the label «Zeitalter der Fugger» in some way is an exaggeration. Besides the Fuggers other upper German rnerchants and Italians, especialy Genoese bankers, had a rather considerable part in the banking activity of the first half of the 16th century. This is especially proved by the situation in Spain which has been studied by Ramón Carande. lt is the intention of the article to show who, besides the Fuggers, at the time of Charles V., were bankers of the Spanish Crown: Germans, Italians, Netherlanders and Spaniards.

The Kreditanstalt der Deutschen ( the co-operative society of the Schulze-Delitzsch type ) was founded by a nationally-oriented association called the Bund der Deutschen. In the course of the 1930s it became an important financial institution, as the...

The Kreditanstalt der Deutschen ( the co-operative society of the Schulze-Delitzsch type ) was founded by a nationally-oriented association called the Bund der Deutschen. In the course of the 1930s it became an important financial institution, as the special articles in its code of rules, the number of its branch-offices and its big capital power allowed to behave on the financial market like a commercial bank. It was distinguished by its traditional and exceptionally strong nationalism and the political involvement of its key representatives. In the beginning the Kreditanstalt der Deutschen was linked with far-right national parties (DNP, DNSAP) and then it reached a mutual understanding with Konrad Henlein’s Sudeten-German Party. This nationalistic orientation continued in cooperating with Hitler’s NSDAP and the Nazi occupational administration (Reichsprotektor, Gestapo). The bank operated on strict principles of economic nationalism. The most important criterion when providing loans was the support of the German economy which was «endangered» by the Czech element. The institutes’ clients comprises almost half a million German speaking inhabitants and its questionable economic activities caused numerous economic problems that had to be solved by repeated secret transfers of funds from the German Reich. During World War II the Kreditanstalt der Deutschen was an important participant in the «Germanization» of Czech economic life and «Aryanization» of Jewish property.

The crises of Barings bank in 1890 and 1995 anchores Barings in banking history. In the crisis of 1890 liquidity problems of Barings in London were induced by its heavy engagement in Argentina. The massive sale of American securities by London was an...

Untertitel: Ein Beitrag zur Analyse ihrer Ursachen, Abläufe und Folgen.The crises of Barings bank in 1890 and 1995 anchores Barings in banking history. In the crisis of 1890 liquidity problems of Barings in London were induced by its heavy engagement in Argentina. The massive sale of American securities by London was an attempt to save Barings from illiquidity. This again led to failures of banks in the USA. A domino effect was created. The overindebtedness of American banks could not have been prevented by a lender of last resort, since the problems which led to the failures in the USA were no liquidity problems.

After all, Barings failed in the crisis of 1995. Its overindebtedness was caused by Leeson’s heavy speculative trading in financial derivatives and simultaneously guided and even facilitated by a lack of adequate internal and external controls. New supervisiory rules were introduced after both banking crises.

The resilience of business families in times of crisis. Haniel, Stumm and the «double» structural change.

In order to promote the longevity of their family firm, business families must be able to cope successfully with external and internal str...

Untertitel: Haniel,Stumm und der «doppelte» StrukturwandelThe resilience of business families in times of crisis. Haniel, Stumm and the «double» structural change.

In order to promote the longevity of their family firm, business families must be able to cope successfully with external and internal stressors. Their resilience in times of crisis derives from a combination of organiizational, indivudual and family factors. Based on these assumptions, the article examines the way in which two German business families, Haniel and Stumm, have dealt with the «double» structural change that they faced between the 1950s and 70s. The Haniel family succeeded in recognizing the necessary separation from their coal and steel heritage at an early stage. Moreover their leading representatives were able to adapt the family policy to the grown and recently reunited sharehlder community. In addition and paradoxically, their spokesman did not find a voice in his vain attempts to fight against the intra-family estrangement that weakened the «belief system» of the family. These contrasting examples show that the resilience of business families must be seen as a historically shaped resource that is heavily influenced by non-economic psychological abilities and accomplishments.

Studies have been published to show that corporate funding of the arts was at least partly motivated by the desire to enhance profits, especially in the 1980’s. This in turn suggests the question: to what extent does corporate funding of the arts a...

Untertitel: Promoting the arts at the Deutsche Bank: Means to an end? Implementing the Concept of Art in the Workplace at the Bank’s headquarters in FrankfurtStudies have been published to show that corporate funding of the arts was at least partly motivated by the desire to enhance profits, especially in the 1980’s. This in turn suggests the question: to what extent does corporate funding of the arts also promote artistic development per se? Using the Deutsche Bank headquarters in Frankfurt as an example, this study explores this question, investigating the extent to which the Deutsche Bank’s funding of the arts was profit-oriented on the one hand or promoting artistic development regardless of profit on the other. The study finds that that although art in general was supported, the four aspects studied specifically (support of artist, conservation of art, aesthetic circumstances and educational purposes) were not realized or communicated consistently. Rather it became evident that Deutsche Bank support for the arts was not an end in itself, but instead was used as a tool of corporate communication at the expense of support for artists and educational purposes.

Die Lehrjahre eines Bankherren: Moritz von Bethmann, 1826 1845Autor/Hrsg.: Heyn, UdoJahr: 1972

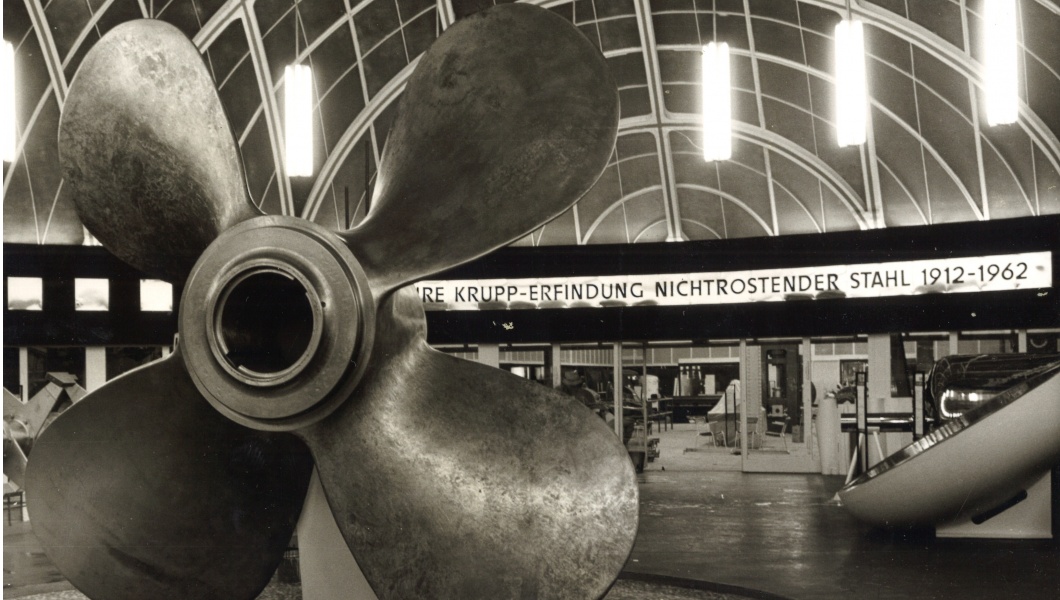

Die maritime Wirtschaft im Lichte der modernen Wirtschafts- und UnternehmensgeschichteAutor/Hrsg.: Wixforth, Dr. HaraldJahr: 2020Maritime Economy in the Perspective of Modern Economic and Business History

The maritime economy has been the leading economic sector of the German coastal regions since the beginning of the early modern era. In contrast to its importance for the soc...

Maritime Economy in the Perspective of Modern Economic and Business History

The maritime economy has been the leading economic sector of the German coastal regions since the beginning of the early modern era. In contrast to its importance for the society and economy of the North Sea and Baltic regions, the interest of Economic and Business historians in its development within those regions during the last three centuries has been comparatively low. Most studies concerning shipbuilding are dominated by more political-historical focused approaches, which leave aside significant research questions that would benefit our understanding of the specific development of the maritime economy and its businesses. In order to fill this gap and reach the level of research other nations have, significant efforts are necessary. Provided that enough source material is available and access to it is not limited by institutional restrictions, the maritime Economic and Business history in Germany is looking at promising prospects. To use this opportunity would expand our knowledge about the development of the «leading sectors» of some of the most important economic regions in Germany, especially, if the research questions and strategies of the modern Economic and Business history are applied.